Call us to book a FREE 30 minute call with a Specialist

020 3376 7910

It's Time to Reclaim and

Reframe Legacy

We’re told a will is protection—when in truth, it’s only the illusion of security.

Trust Thy Will exists because someone needed to tell the truth.

We’ve seen too many families lose everything.

Not through carelessness, but through trust in outdated solutions.

That ends now - with us.

Most families are playing Monopoly without a strategy—just hoping to pass Go, collect what's left, and stay out of trouble.

But the wealthiest families know that the real power isn’t in owning a few houses—it’s in knowing how to buy the board, protect the assets, and pass the game on with clear rules everyone understands.

We're here to help your family stop playing to survive—and start playing to win.

Together.

Generation after generation.

The Problem We're Here to Solve

For hundreds of years, the wealthiest families in the world have quietly used a three-part formula to ensure their legacy lasts:

Strategy. Structure. Stewardship.

It’s not luck.

It’s a system—refined, protected, and passed down behind closed doors.

The problem?

This system has been the best kept secret of the ultra-wealthy,

while everyday families are handed basic wills and told they’ve “done enough.”

They haven’t.

We're making the principles once reserved for dynasties available to every family

that cares enough to do things properly.

Who Are We?

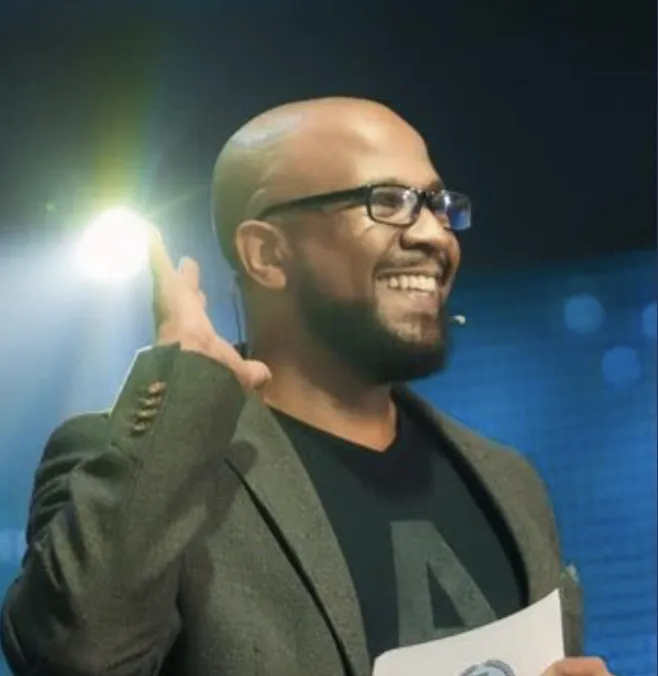

Sean Godson

FOUNDER

Legacy Architect | Family Office Strategist | Succession Specialist |

I’ve worked as a professional estate planner for over 12 years—guiding individuals, business owners, and families through some of the most important decisions of their lives. I’ve helped people protect their assets, preserve their wishes, and put the structures in place to ensure what they’ve built doesn’t just transfer—it continues.

Simultaneously I have also spent years in corporate leadership, working with some of the world’s largest multigenerational companies. This experience has taught me that the most enduring legacies aren’t built on luck—or even wealth alone. They’re built on vision, strategy, structure, and clear pathways for succession. That insight shaped everything I do today.

My personal journey has been about rebuilding connection and reclaiming legacy from the inside out. I didn’t get to raise my first two sons—but I’ve had the privilege of raising my third. That contrast changed me. It made me want to bring my own family back together, and it gave me a mission that now reaches far beyond my own story.

That mission is Trust Thy Will —and our sister companies Know Thy Will and Legacy Creators—where we help families think differently about the future. Families who want to go beyond what they were told was possible, and who are ready to build with intention.

I’m especially passionate about helping people adopt a Family Office mindset —regardless of current net worth—because legacy isn’t about how much you have.

It’s about how well you manage, protect, and pass it on.

In many communities legacy planning is often avoided—perhaps because of generational trauma, systemic mistrust, or the belief that it’s only for the wealthy. But the truth is, we all have something to protect. And we can’t afford to leave it to chance.

I’ve seen too many people lose everything through poor or delayed planning, and too few realise that they could build something extraordinary—if someone simply showed them how.

That’s why I do this work:

Stop leaving it to chance—let's build something that lasts.

Michelle Mahal

FOUNDER

Legacy Creator | Business Growth Coach | Communication Strategist |

I've helped my clients craft messages and conversations that have generated millions in revenue. Now I help Legacy Creators turn their lived experience into messages and conversations that create compounding, exponential generational wealth.

My journey into legacy work and the evolution of what I do wasn’t planned—it was divinely guided.

Amongst all the business and personal development books on my shelves, you’ll also find thick volumes on

Equity and Trust Law.

I studied them out of curiosity, not credentials—drawn to the power of protection, structure, and stewardship long before I realised this would become my life’s work.

When I became a single mother, everything changed. I knew that whatever I was going to create—financially and emotionally—had to come from me.

When I met Sean, he introduced me to the world of estate planning and my vision and purpose expanded. I could see how this work isn't just about protecting money—it is about bringing families closer than they’ve ever been before.

My mother is Filipino and in her culture you're taught to sacrifice, to care for one another, and keep going no matter what—but we rarely talk openly about money, inheritance, or what happens when we’re gone. Legacy is often left to faith, not structure. But I believe it's time to stop seeing these conversations as taboo, and start seeing them as love in action.

This work became soul-deep for me when I lost one of my dearest friends, Millie.

It was just before Christmas 2017. She had lovingly wrapped her sons’ presents and placed them under the tree… but she never got to see them open them. Her death shattered something in me—and clarified something else: we don’t get to decide when our time ends, but we can decide how prepared we are.

Last year, I held my nan in my arms as she took her final breath—on the exact date I’d first become a mother, 17 years earlier. I'd learned so much from her, but in that moment, I realised I’d never hear her voice again. And it made me even more committed to helping others protect not just assets, but stories, voices, values and wisdom. I'm here to help you build a legacy that is not only protected—but deeply felt, shared, and carried forward through many generations to come with love.

Copyright Know Thy Will Ltd 2025.

All rights reserved.

Trust Thy Will is a trading name of Know Thy Will Ltd, 3rd Floor 86 - 90 Paul Street, London, EC2A 4NE. Company number: 16201711. England & Wales. Know Thy Will Ltd clients are covered under the benefits and Terms of the Know Thy Will Ltd Professional Indemnity and Public Liability Insurance. Know Thy Will Ltd are not regulated by the Solicitors Regulation Authority or the Financial Conduct Authority. Know Thy Will Ltd utilises the Services of specialist firms regulated by STEP, SRA and FCA. Know Thy Will Ltd does not provide financial advice. Clients needing financial advice will be introduced to a specialist Independent Financial Advisor, authorised and regulated by the Financial Conduct Authority. The Financial Conduct Authority does not regulate taxation and trust advice.